Apply Now

Apply Now

Low-Cost Loans for Employees

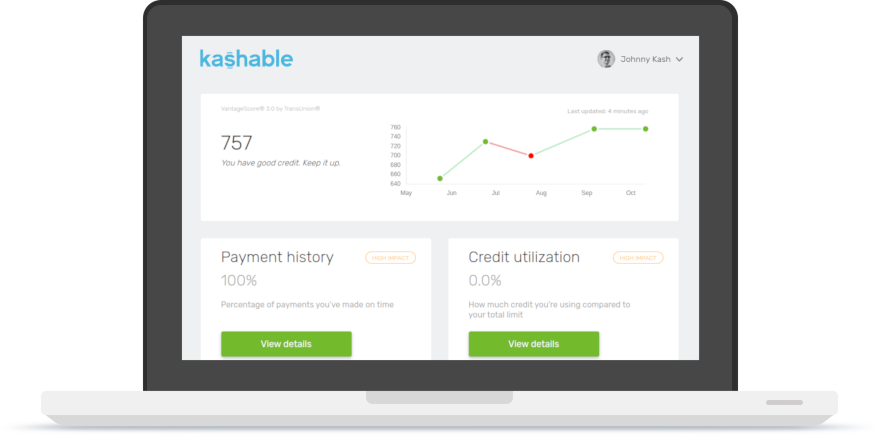

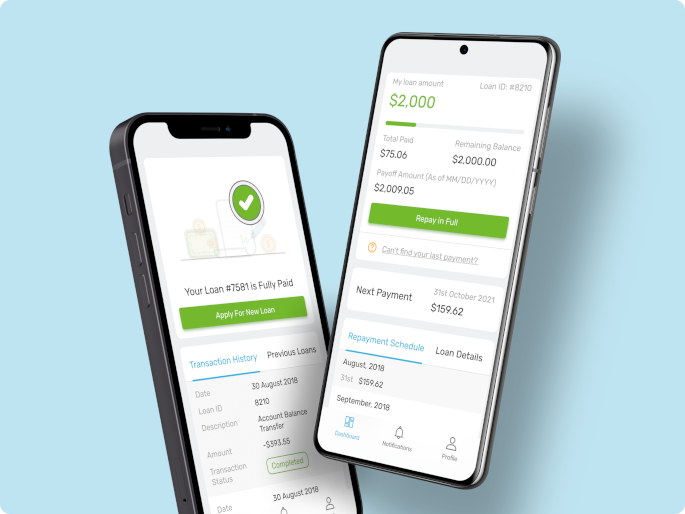

The Kashable employee benefit program is available exclusively to employees. We have designed the program to offer low cost loans with fast approval and funding deposited directly to your bank account.

Check Your Rate