Apply Now

Apply Now

Low-Cost Loans for Employees

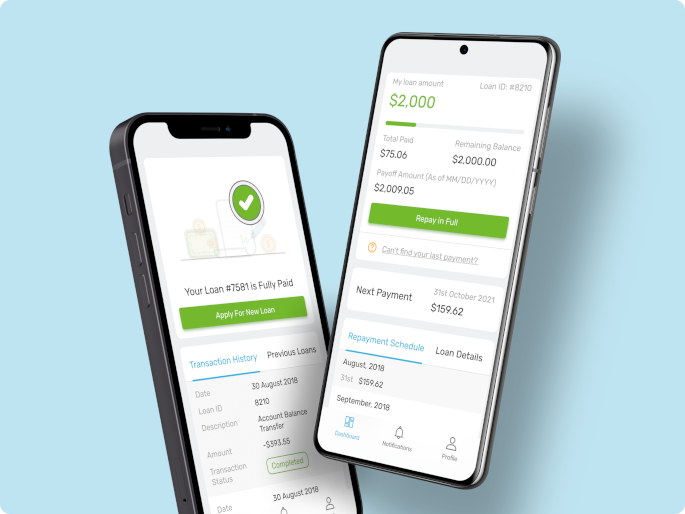

Kashable offers employees a better way to tackle costly debt and unexpected expenses. That’s why we call it Socially Responsible Credit™

Check Your Rate Apply Now

Apply Now

Kashable offers employees a better way to tackle costly debt and unexpected expenses. That’s why we call it Socially Responsible Credit™

Check Your RateChecking your rate will not affect your credit score with the major credit bureaus

Low Fixed APRs

Kashable is the latest to grab some venture capital attention for its approach to offering credit and financial wellness products as an employer-sponsored voluntary benefit.

As an alternative, employers are joining with firms such as Kashable to help fund and service loans.

Kashable's mission is to improve the financial well-being of working America. The company offers socially responsible financing to employees as an employer-sponsored voluntary benefit.

Kashable aims to bring more equity to the financial services industry by providing equitable access to financial education and low-cost loan benefits for employees.

In response to a spike in employees seeking loans against retirement accounts amid COVID-19 financial strains, Reid Health introduced Kashable, a business that offers short-term loans to those who have difficulty getting other types of financing.

In a world where financial instability can strike anyone, at any time, Kashable is taking a bold stance: access to credit shouldn't be a privilege, it should be attainable.

“We integrate seamlessly with employer Human Resource Information Systems (HRIS) and payroll systems — enabling quick access to affordable loans that are automatically repaid through payroll without much of a lift to the employers,” Einat Steklov said.

Under this partnership, participating employers are for the first time empowered to offer SecureSave's emergency savings accounts and Kashable's low-cost loans all under one dashboard.

Fintech leaders highlight the growing trend of employers focusing on financial wellness and development programs for their employees.

PlanSource, a leading provider of cloud-based benefits administration technology, announced that Kashable has joined the company's Partner Marketplace.

Brokers who offer Kashable benefits will have access to the full suite of Paylogix® enrollment and billing solutions including employer level billing and payment, client portal, and alternative funding.

Einat Steklov, co-founder of Kashable, discusses leveraging technology to revolutionize access to low-cost credit for Americans, emphasizing financial wellness and the impact of Kashable's patented technology within the fintech space, and HR organizations.

Kashable LLC | 500 5th Ave.·Floor 27 | New York, NY 10110